Tax Calculator 2025 Hk. Calculate you annual salary after tax using the online hong kong tax calculator, updated with the 2025 income tax rates in hong kong. Calculate your income tax, social security.

The free online 2025 income tax calculator for hong kong. Select a periodic pay calculator below, continue reading to view the detailed instructions for this set of calculators or access alternate tax.

If you have received back pay, gratuities, terminal / retirement award, you may apply to have the lump sum.

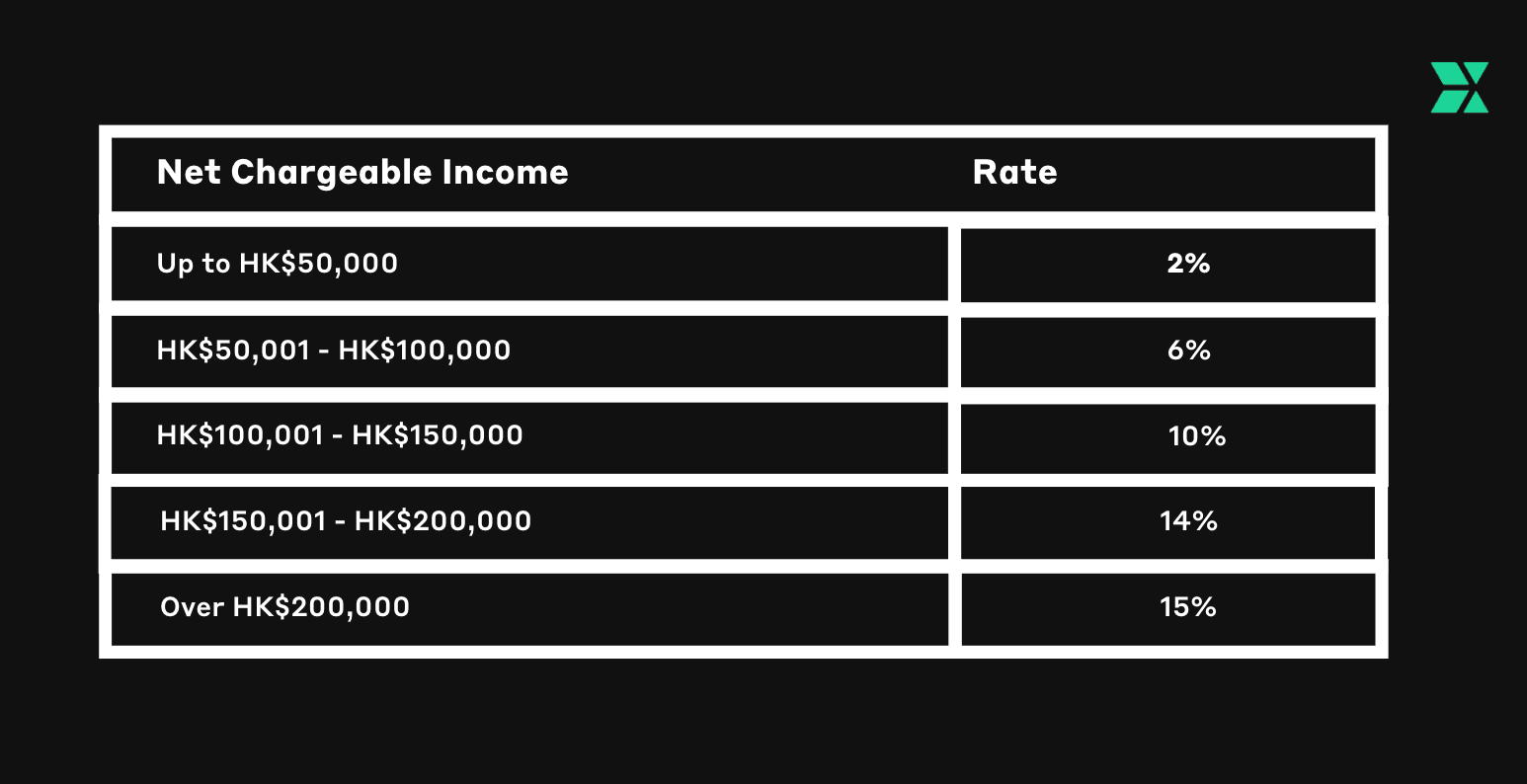

How to Pay Taxes in Hong Kong, Calculate your income tax, social security. Hong kong sar has progressive income tax rates from 0% to 15%.

85k Salary Effective Tax Rate V's Marginal Tax Rate HK Tax 2025, Select a periodic pay calculator below, continue reading to view the detailed instructions for this set of calculators or access alternate tax. You'll then get your estimated take home pay, an estimated breakdown of your potential tax.

Tax rates for the 2025 year of assessment Just One Lap, If you have received back pay, gratuities, terminal / retirement award, you may apply to have the lump sum. You may use the tax calculator provided in govhk to calculate your 2025/24 and 2025/25 salaries tax and tax under personal assessment.

HK Salaries Tax Calculator Apps on Google Play, New delhi 40 o c. If you have received back pay, gratuities, terminal / retirement award, you may apply to have the lump sum payment.

Tax Calculator FY 20232024 How to Create Tax, Calculate your income tax, social security. Hong kong sar has progressive income tax rates from 0% to 15%.

HK Salaries Tax Calculator Android Apps on Google Play, New delhi 40 o c. If you have received back pay, gratuities, terminal / retirement award, you may apply to have the lump sum payment.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, Hong kong sar has progressive income tax rates from 0% to 15%. Effortlessly calculate your income taxes and relevant social.

270371 270,371.00 Tax Calculator 2025/25 2025 Tax Refund Calculator, Reducing profits tax, salaries tax and tax under. New delhi 40 o c.

Federal Tax Calculator 2025 Paycheck Nelie Xaviera, Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results. You can calculate your tax liability under salaries tax or personal assessment by using a simple tax calculator developed by the inland revenue department.

Currenxie An Easy Guide to Understanding Hong Kong’s Tax System, If you have received back pay, gratuities, terminal / retirement award, you may apply to have the lump sum. If you have received back pay, gratuities, terminal / retirement award, you may apply to have the lump sum payment.